In this post, we’re going to look at profit margins for Amazon sellers, including what constitutes a good ROI for products sold on Amazon and what is a realistic profit margin to aim for as a seller on Amazon.

When thinking about your Amazon ROI, it’s very important to factor in Amazon fees and the cost to ship your products to Amazon FBA warehouses. These expenses make a huge difference to the Amazon seller profit margin you are going to enjoy.

In other words, ROI is more than just the difference between the price an item sells for on Amazon and the price you can obtain it for.

This may seem obvious to some of you, but many beginners don’t realize this and invest in inventory that has no hope of turning a profit.

What is a good ROI for FBA?

When you are first getting started on Amazon, all the fees and numbers can get overwhelming when you are trying to figure out how much money you are making and what you should be doing to make more.

Understanding your ROI and profit margin will help you with this.

ROI is your profit per item divided by how much it cost to buy the item. So if you bought an item for $10 and earned $10 profit, that would be a 100% ROI. If you only earned $2 profit, that would be a 20% ROI.

Whether or not your ROI is “good” depends on a lot of factors.

The biggest mistake that many beginners make is not factoring in Amazon fees.

For example, beginners will look at an item they can buy for $15 and sell for $25 via FBA and assume that means they are making $10 profit with ~67% ROI – this is not the case! By the time all the FBA selling and shipping fees are factored in, the actual profit will be less than $5 with an ROI that is likely less than 30%.

The 3x Rule

The most common strategy employed by beginning sellers looking for a healthy ROI on Amazon is to look for items that can sell for triple what you pay for them.

This is often called the “3 times rule” or the “3X rule” and in general creates a 100% return on investment. This is a safe and healthy Amazon FBA profit margin because it allows new sellers to skip over specific fee calculations while still turning a profit.

The idea with this rule is that if you buy an item for $5, you should be able to sell it for $15. In this scenario, $5 is paid for the item, $5 is paid to Amazon for shipping and fees, and the remaining $5 is your profit. $5 profit on a $5 purchase equals a 100% ROI, which is definitely an acceptable return on investment.

Why The 3X Rule Will Limit Your Total Amazon Profit

An Amazon profit margin of 100% is a good rule of thumb for those who are just getting started selling on Amazon, but eventually, you’ll need to adopt a more advanced strategy if you want to maximize your Amazon profits.

If you were able to consistently spend your entire sourcing budget on items that provide a 100% ROI, then you should definitely keep sourcing 100% ROI items as long as possible.

At some point, though, you will be unable to spend your full sourcing budget on 100% ROI items. Your budget will grow to the point that there just aren’t enough items to buy that provide that level of ROI on Amazon. That’s when you’ll need to lower your acceptable ROI if you want to expand your business as much as possible.

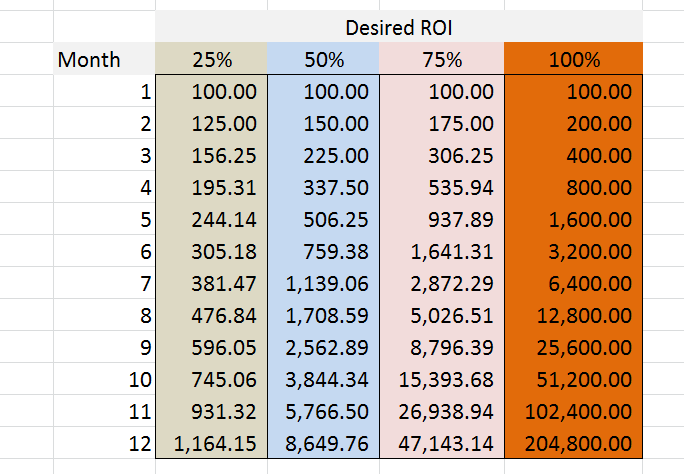

Here’s a chart (click to enlarge) showing how much you end up with if you start with a $100 sourcing budget and are able to obtain your desired ROI each month and you reinvest all profits each month:

So here you can see what reinvesting all of your profits will get you if you were able to spend your entire sourcing budget each month and have all of the items sell again every month.

Now, I am guessing you are going to start running into problems continuing to spend your entire sourcing budget on 100% ROI by month 7 and run into very strong resistance around months 9 to 10 based on the chart above. There are multiple reasons for this, but being able to find enough items that make 100% return on investment will likely be one of the more significant issues.

How To Maximize Profits On Amazon

Below you’ll find 2 scenarios that demonstrate what I am getting at with this post.

A couple of overarching assumptions are that this individual is able to spend $5,000 on items that will yield a 100% ROI and $10,000 on items that will yield a 50% ROI every month.

Example #1:

- You begin with a $10K sourcing budget.

- You WILL NOT buy anything with an ROI less than 100%.

- You can consistently find $5K worth of 100% ROI items per month.

- You consistently pass on every item that has an ROI less than 100%

- You consistently find $10K worth of 50%+ ROI items that you never buy.

- You end up making $5K per month. Your sourcing budget for the subsequent month has now increased to $15K.

- Even though your sourcing budget has increased, you are consistently making $5K per month, with a few months being better and a few months being a bit less, depending on how your sourcing turns out month to month as there are only so many 100%+ ROI items that you can find.

Example #2:

- You begin with a $10,000 sourcing budget

- You are willing to buy items with an ROI as low as 50%

- You buy every item that has a 50% ROI or greater regardless of when you find it during the month.

- The first month you spend $10K on inventory, $6.7K on 50% ROI inventory, and $3.3K on 100% ROI inventory.

- You end up making $6.7K in profits the first month.

- Your sourcing budget for month 2 is $16.7K.

- In month 2 you are able to buy all $10K of the 50% ROI items, and all $5K of the 100% ROI items with $1.7K unspent. At the end of the month, once these items sold, your sourcing budget increased by $10K up to $26.7K.

- You continue to source all of the 50% plus ROI items you can find and continue to make $10K per month.

Now, this is more of in theory versus in practice, as it’s highly unlikely that you will be able to find the exact same amount of inventory every month and have it all sell within the month. Also, the numbers used are arbitrary.

You could change the sourcing budgets around as you see fit to make them work for your personal situation. Just make sure to redo the math. Even though this is somewhat theoretical, I believe there is real value in considering the above example when choosing your required ROI when sourcing products.

Now, a few notes on the above examples.

First, if you get to a point where you are comfortable with the amount you are making and the amount you are working, then by no means should you consider it necessary to lower your ROI to increase your income.

But if you consistently have part of your sourcing budget leftover at the end of each month, and you would like to make more money, I think it’s worth considering lowering your ROI a bit to do this.

In comparing the 2 examples, it’s worth noting that it would take the person in example #2 less time to source $5K in cost of products to resell than in example #1. The individual in each example would be scanning the same number of items, but in example #2 would be buying a significant number of items that would be left behind in example #1.

So, in reality, lowering your ROI is unlikely to add too much time initially to your sourcing, and might even decrease it. Lowering your ROI will likely increase your prep/shipping time as you will have additional items to deal with, but the time savings from sourcing will help to cover this additional time.

There are some additional risks to lowering your required ROI, such as prices going down to a point where you are unable to profit, and returns cutting more significantly into profits, among others. Be sure to account for these risks if you decide to accept a lower ROI.

In my own business, we base our purchasing decisions on a combination of ROI and the sales rank of the individual item. In other words, I’ll accept a lower ROI on items that will sell faster and look for a much higher ROI for items that will take longer to sell.

Need Help With All These Numbers?

If you are new to selling on Amazon and looking to get your first sales, I recommend checking out our Launch Accelerator. This is a guided 4-week program where you will work directly with my team and I to get your Amazon business up and running with guaranteed results. This usually sells out very quickly, but you can check availability or get on the waitlist here.

A Couple Discounts That May Help You

Before I wrap this up, I wanted to post quick about 2 exclusive discounts that are available through my blog on 2 services that I am using.

The first is for Shoeboxed, which is a service that I am using to manage my receipts. I simply send my receipts to Shoeboxed in the mail, and they scan them into an online portal where they are stored and easy to access. If you sign up through THIS LINK you can get a 30 day free trial, and if you decide to pay for the service you will receive a 20% discount for your first 6 months.

The second is for Appeagle. This is a repricing service that I have been using for about the past month. So far I am really liking the results of this, as it has helped me to sell through some older inventory, as well as sell through some of my newer inventory quicker and sometimes for higher prices than I initially listed the item for, it will save me a lot of time versus repricing manually going forward. You can sign up for a 14 day free trial through THIS LINK and if you use coupon code “RYAN_G” for 50% off your first month if you decide to continue using the service. Note: the coupon code is entered when entering your payment details if you decide this is a service you want to use, and not when signing up for the free trial (no credit card is required for the free trial).

—

That’s all I have for today. What ROI do you look for when sourcing? What other factors should be considered? Any questions for me? Let me know in the comments below!

If you are selling in US you really should factor in expenses paid to IRS, state taxes or whatever else tax you need to pay when you are able to pay yourself a salary.

Also if you are doing this full time you may also need to consider paying for your health insurance and any money towards your retirement account like an roth or traditional IRA since you don’t have an employer to help with those.

Taxes, health insurance both can take up a big chunk of your money. And an IRA account is up to you but it’s something you should seriously consider.

How can you make a profit if your ROI is lower than 100%? (considering high sales volume.) Please explain with an example using numbers.

How does this person make his money back? (e.g. if he makes an $100 investment, how and when will he make his money back, plus earn a profit; with say 50% ROI)

With a $100 investment, a 50% ROI would mean that you’re getting back the initial $100 and an additional $50 on top of that. Lets say that you end up paying $25 in fees between FBA, prep, inbound shipping, etc… Your profit is then the leftover $25.

Hello Everyone,

I have a question about the formula. I would like to put the formula that is in the table in excel so I can do calculations to help forecast how much budget would get me to a end result.

What is the formula and is this called compound interest calculation or exponential growth calculation?

Hi Jeffrey,

I’ve approved your comment, so we will see if anyone comes up with an answer.

Best Regards,

Ryan

This is a great post, Ryan. Thanks so much for sharing your insight!

I just started FBA about 30 days ago and have so far found that I am sourcing a lot like Diana’s comment above.

However, I really want to be a lot more strategic about purchases moving forward and this post is exactly what I needed to help get me there.

I am doing a lot of thrifting and loving the ROI on my thrifted items, but am finding that most of them are long-tail items, so it’s interesting game to prioritize ROI or rate of sale.

Hey Jessica,

Glad to hear it’s helpful!

Best Regards,

Ryan

Hi Ryan, I’ve been selling on Amazon for 3 ½ months now. So far, I’ve lost money in May, June and July because even though I saw great ROI’s on many of my items, I didn’t have enough volume to cover my front end expenses – supplies, printer, training videos, state tax registrations, etc., so I did lose money each month. However, this month, August, I am confident that I’ll see my first monthly profit as sales as I have my highest sales month thus far without any large expenses.

Though ROI plays into it, I tend to also look at profit, number of items, ease of prep and end goal.

Let’s say that I have a goal of making a $1000 profit each month. By using the 3X Rule that you mentioned, I would get there by buying $1000 of products and selling them for $3000.00. Though it makes sense, my brain doesn’t operate that way and it’s easier for me to say that I need to buy 25 items per week that will give me a $10.00 profit each. So now, I have covered my target profit and number of items to shoot for. (25 items x $10.00 profit x 4 weeks = $1000.00 month profit)

Then, ROI is my next factor and I’ll consider a product even if the profit is under $10.00 or I may not buy it even if it will give me a $10.00 profit. For example, I’ll pay $1.00 to make $6.00, but I won’t pay $30.00 to make a $10.00 profit.

If the profit and ROI makes sense, then I look at prepping. If it’s a large, odd-shaped item with 5 price stickers on it, I may pass on even if it’ll give me a $10.00 profit. If it’s tiny, brand new, no stickers and costs just $1.00, I’ll buy a few even if my profit will be under $10.00.

Well, to wrap this up, my point is, is that I do look at ROI but it’s not my only determining factor. Of course, also the item ranking is a consideration also.

Hi Diana,

Thanks for sharing, I definitely agree with many of the things you are looking at as well! Just in case it wasn’t clear in the initial post, I am factoring in many additional factors besides ROI, but I just wanted to focus on the ROI piece of the sourcing puzzle in this post post.

Best Regards,

Ryan

I love posts with “numbers” in them. I’m a numbers guy, so it’s great to see posts like this.

There is another factor to think about here when you are determining weather to take a lower ROI item or not. All of the factors above assume all items sell once per month. In a good majority of cases, lower ROI = higher sales volume. Of course, this isn’t a rule – but is something to keep an eye out for.

An example: You have $1,000 to source. If you find $1,000 of product that has 100% ROI that will sell within a month, then you will have an additional $1,000 the next month.

Say you have that same $1,000, and you find $1,000 of product that has 50% ROI, but it will actually sell within a week. That same $1,000 will be able to reinvested every week, instead of every month. That same $1,000 turns into $1,500 after week 1. If you only reinvest that original $1,000, you’ll gain another $500 after week 2. Ultimately, at the end of the month, if you actually didn’t utilize any of the profits at all for sourcing, you would end up with $3,000 total, instead of $2,000 total like you would in the 100% ROI scenario above.

Of course, all of this is hypothetical to get you thinking. In reality, there are lag time issues you have to worry about – specifically the Amazon payout lag time. You might send in 100% ROI product that sells once per month, but if the timing is right, you might not see the proceeds of a good chunk of the sales for up to 6 weeks due to the bi weekly payout most Amazon accounts have. Having items that sell on a quicker pace at a gives you working capital much faster to be able to turn again.

Hi Chris,

Great insights, and I definitely agree that lower ROI items can/should turn over faster. Hopefully the examples I initially gave, as well as yours here, will help people to consider the potential outcomes of lowering their desired ROI.

Best Regards,

Ryan

Great post. One additional factor to consider is the time it takes inventory to sell. In general, fast-selling items have low ROI, and high-ROI items sell slowly.

Say you sell items that have 100% ROI and take a month to sell. In one month, you’ll double your money. If you reinvest the profits, in two months you’ll have four times your original investment.

You also sell items that have 50% ROI, but take only two weeks to sell. In one month, you can sell out your stock, reinvest, and sell out again. You’ll more than double your money by the end of the month, and after two months you’ll have over five times your original investment.

In the right circumstances, a lower ROI can actually be more profitable.

Hi Dawn,

This is an excellent point, thanks for sharing!

Best Regards,

Ryan

Hey Ryan,

I see where you’re coming from and the logic behind accepting lower ROI. You might remember I asked a sort of prelude to this from your last post.

The problem that I’m having right now is finding ANY inventory, even stuff that’s 50% ROI is hard to come by.

I live in a pretty sizable city that’s pretty non-tech savvy, I never see any other scanners out there. But it’s almost impossible to find any inventory. Toys R Us, Target, Walmart, you name it, I’ve tried it. The most I ever leave with is like around $100 worth of inventory.

So my question is, is the inventory heavily location dependent? Do you gotta look beyond clearance and just scan everything? Or am I missing something totally obvious?

This guy’s post on this website summed up the experience that I’ve seen:

https://imimpact.com/truth-about-fba/

In fact, I’m fairly certain Howard Harkness reads your blog haha. Or at least his wife does. She commented on your post about sales tax.

Anyways, comments shouldn’t be longer than the actual post. So I’ll stop myself now.

Looking forward to your insights,

Will B.

Hey Will,

Thanks for the comment, and yes I do remember your prelude to this question. This post is not strictly about retail arbitrage, as the lowering of margins can be applied to any method of sourcing. It definitely can be applied to retail arbitrage, but that is not the only means that I am using to source product. I also source product online, and have just started wholesale sourcing, and this post can be applied to each of those as well.

As far as nothing being available in your stores, it’s definitely possible that your area is not as retail arbitrage friendly. I would also bet that there are items that you have not discovered yet in these stores. For example, I have purchased full price items at Walmarts, Targets, Toys R Us, and many other stores and made over 50% ROI. Some of these are consistent sellers for me, while others I sold a few of and that was it. I am betting that there are more deals out there, they just are a little hard to find. I would also recommend trying some online sourcing, thrifting, and possibly wholesaling to get to a point where you are getting inventory from a variety of places.

That interview post with Howard Harkness is quite interesting, I just read through the whole thing. I think that’s a realistic view of retail arbitrage and shows that it’s a good amount of work to get any solid results. I can’t speak for every area of the country, but so far, from the traveling I have done I have been able to source inventory in every area where I have tried. This doesn’t mean I never walk out empty handed, and sometimes I do only spend $50 or so per store, but even spending a relatively small amount per store can add up if you make it to 10+ stores in a day.

Hope some of this helps, and let me know if you have further questions.

Best Regards,

Ryan

Thanks for your response Ryan. I knew there must have been something I was neglecting, the full priced items.

I’ll have to make more time to get acquainted with them in my local stores. Do you recommend a grind it out philosophy? Just going in and scanning everything? From the books/research I’ve read, it seems like this is the best way to get that “feel” & knowledge for FBA friendly items.

Also, read your review for the Online Sourcing from Jessica. I’ll be picking that up to work on my online game. You mentioned wholesale as well. I don’t see any books/courses from your resources section. Do you have one that you’ve found to be helpful?

Hey Will,

If you have the time I think a grind it out philosophy and scanning virtually everything makes sense at certain times. Generally, I will scan an additional 10-20 full priced items every time that I am in a retail store. Scanning a significant amount of items does let you get the “feel” for what will likely sell well.

As for wholesale, ThriftingforProfit.com has a podcast that covers quite a bit of info on wholesale, but I haven’t found any books/courses thus far that I have used. If I find something further, I will be sure to share.

Best Regards,

Ryan

Hey Ryan,

Thanks for that. Time is definitely not a commodity I have. At least, not in terms of being away from the computer. As you know, I also have a full time job that requires quite a bit of my time in front of a a monitor haha.

But wholesale is very appealing cause it deals in research, a lot of which can be done online.

I’ve come across thriftingforprofit in the past. I never saw their podcast session though.

Hey, hopefully I can start giving you some help/knowledge instead of always asking for it!

Cheers,

Will

Hey Will,

You are welcome, and yes wholesaling can be very attractive due to the amount of time you have available. No worries on asking for help, but if you learn something you think would be particularly helpful that you are willing to share, definitely feel free to let me know.

Best Regards,

Ryan

The ROI is 50% not 100%. $5 for cost of goods sold plus $5 for shipping and fees thus equals $10 invested not $5.

Hi Kem,

Thanks for the comment. You only pay the additional to $5 if the item sells, so you really aren’t investing the additional $5. So while technically your comment is true, the way I look at it is the amount I pay for the item and the amount I get paid for the item. in the example mentioned I invest $5, get a net payout of $10, and have a net profit of $5. The additional $5 is not something that ever comes directly out of my pocket, so I don’t factor that into the initial ROI calculation.

Best Regards,

Ryan

Hi Will B I’m in the same situation as you. I live in one of the largest cities in the country with tons of all types of stores within a within a stones throw and having a heck of a time myself finding inventory. I’ve been at this for a week and haven’t found anything. Probably because I’m not sure of the metrics I need.

Hey Marc, where are you based out of? I’m in Northern California, in/around the Bay Area (SF, San Jose, etc).

Since I posted that I’ve tried more stores and it’s about the same. I can find things here and there but definitely not enough to keep up a >300 items inventory.

My guess is that places with high average income doesn’t need to discount their prices as much? I could be totally wrong on this.

Hi Will Philadelphia area, in and around.